Effective cash management is crucial for any organization aiming to achieve stability and resilience. Proper cash flow management ensures your company has enough funds to cover its daily operations, invest in growth opportunities, and navigate unexpected challenges.

Here, we explore the Top 5 Cash Management Excellence tips to help you drive stability and maintain resilience in today’s dynamic economic landscape. By implementing these strategies, you can optimize your cash flow, reduce financial risks, and position your company for long-term success.

Tip 1: Develop a Comprehensive Cash Flow Forecast

Developing a comprehensive cash flow forecast is vital to drive stability and resilience. A cash flow forecast allows you to project your future cash inflows and outflows, enabling you to anticipate potential cash shortfalls or surpluses.

SolarSucces includes a Cash Projections dashboard tool that allows you to analyze your company’s payables and receivables over the previous four rolling weeks, the current week, and the next eight rolling weeks to gain valuable insights into your cash needs and identify periods of potential financial strain. This enables you to take proactive measures—such as arranging additional financing, increasing accounts receivable collections efforts, or adjusting expenses—ensuring cash flow remains stable during challenging times.

Tip 2: Optimize Receivables and Payables

Effectively managing receivables and payables is another crucial aspect of cash management excellence. You should establish clear and efficient invoicing, collections, and payment management processes. Implementing strategies such as offering discounts for early payments or incentivizing prompt invoice settlements can accelerate cash inflows and improve liquidity.

Similarly, negotiating extended payment terms with suppliers can optimize cash outflows and provide additional flexibility. By closely monitoring and optimizing both receivables and payables, you can maintain a healthy cash flow and reduce the risk of cash crunches.

Tip 3: Establish a Cash Reserve

Building a cash reserve is essential for ensuring financial stability and resilience. A cash reserve is a safety net during unexpected events or economic downturns, providing the necessary liquidity to cover immediate expenses or seize growth opportunities.

Set aside a portion of cash inflows regularly, considering factors such as your organization’s risk tolerance, industry dynamics, and business size. A cash reserve enhances financial security, instills stakeholder confidence, and positions your company to weather turbulent times with minimal disruption.

Tip 4: Automate Cash Management Processes

In today’s digital age, leveraging technology to automate cash management processes can significantly enhance efficiency and accuracy. Automating tasks such as cash reconciliation, forecasting, and payment processing reduces the risk of errors and saves valuable time.

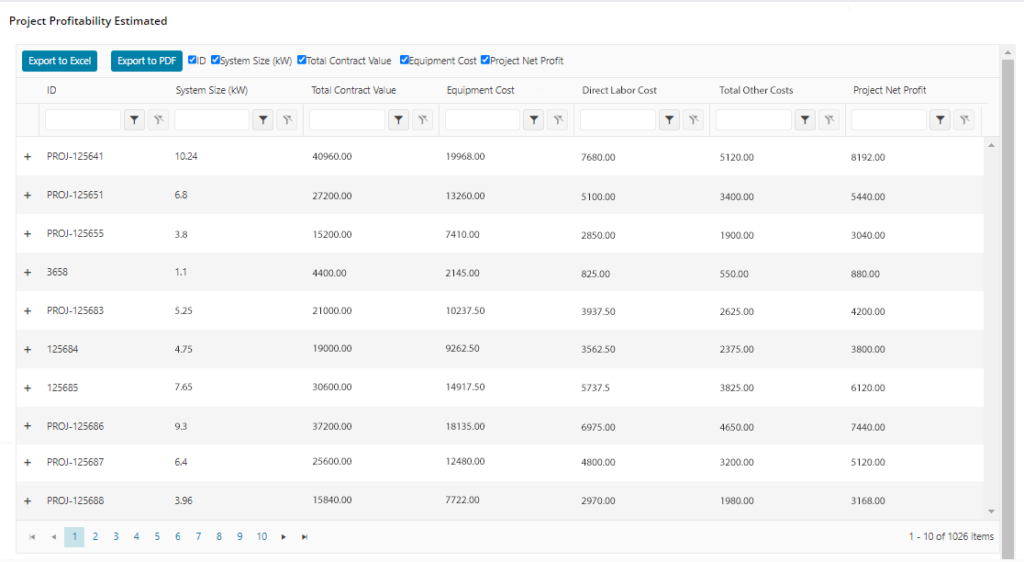

Cash management software and platforms—such as the Cash Management Excellence toolset in SolarSuccess—streamline the collection, monitoring, and allocation of funds, providing real-time visibility into cash positions and simplifying decision-making processes. By embracing automation, you can improve cash flow management, enhance operational efficiency, and free up resources to focus on strategic initiatives.

Tip 5: Regularly Monitor and Analyze Cash Flow Metrics

Monitoring and analyzing cash flow metrics is vital for maintaining cash management excellence. Key metrics such as operating cash flow, cash conversion cycle, and working capital ratio provide valuable insights into your company’s financial health and efficiency. Regularly tracking these metrics allows you to identify potential issues, spot trends, and take timely corrective actions.

Furthermore, by conducting scenario analyses and stress tests, you can assess your company’s resilience to various economic scenarios and proactively adjust your cash management strategies. Additionally, engaging in continuous improvement initiatives and benchmarking against industry peers can help you identify opportunities for optimizing cash flow performance.

Achieving cash management excellence is a critical objective for businesses seeking stability and resilience. Following these top 5 tips, you can establish robust cash management practices that optimize cash flow, reduce financial risks, and position your organization for long-term success.

Through comprehensive cash flow forecasting, optimizing receivables and payables, establishing a cash reserve, automating processes, and monitoring key metrics, you confidently enhance your financial stability and navigate uncertain economic landscapes. SolarSuccess has Cash Management Excellence tools that empower you to adapt to changing market conditions, seize growth opportunities, and stay resilient in facing challenges.

Our team at Blu Banyan is enthusiastic about collaborating with you. Schedule a call today to discuss SolarSuccess and Cash Management Excellence tools. Together, we can contribute to the global shift towards clean energy and discover new opportunities for profitability in your solar business.